How to start a bookkeeping business in 2024: The Ultimate Guide

It will likely be the first form of financing you’ll qualify for and can be a great financial tool to help you with cash flow or necessary expenses early on in your business. It can also be a great way to track your business expenses easily—this will go a long way toward making tax time a breeze. New bookkeeping businesses will typically use a credit card to float working capital expenses, earn rewards, and manage employees. An accounting practice might offer bookkeeping, tax preparation, payroll processing, and financial consulting. Tailoring services to meet the needs of local businesses can help establish a niche. Continuous assessment of client needs can shape future service offerings.

- Paychex Insurance Agency, Inc. may receive a commission from an insurers other intermediaries and/or additional compensation in connection with the sale of insurance to you.

- Professional associations also offer certifications so that you can hone your skills and market yourself as a professional bookkeeper.

- Remember that your business plan is likely to evolve as you learn more about your business in relation to the market.

- Regular training sessions should cover best practices for creating strong passwords, recognizing phishing attempts, and safely handling client information online.

What kind of people work in Bookkeeping?

If you plan to lease office space, then your mailing address will be wherever your office is located. However, if you plan to set up a home office, you’ll need to obtain a business mailing address so that you don’t have to use your home address. This will make your business appear more professional and maintain your privacy. The next decision is whether to focus on a particular small business niche or to offer services to all small businesses. It’s much easier to become an expert in accounting for a particular business niche than for all businesses in general.

Step 1. Registration with federal agencies

Figuring out what to charge is any small-business owner’s greatest challenge. Too little and you aren’t fairly compensated for your work; too much and you’ll have a tough time competing with other bookkeeping businesses. Many clients will look for your website to find out about you and your experience. If you’re specifically running a totally virtual business, a website is extra important since it can demonstrate to clients your skills. And luckily, there are Grocery Store Accounting plenty of website builders to make creating your website a breeze.

Allowable Business Startup Deductions

- Coming up with a unique logo can also play an important role in developing your identity.

- Once you’ve come to an agreement, it’s essential to sign an engagement letter.

- Systems like Pure Bookkeeping can support you as you scale, ensuring your processes are consistent and professional.

- Both traditional, brick-and-mortar banks and online institutions offer attractive banking options, so shop around before deciding where you want to park your hard-earned money.

- Regular financial reviews enable adjustments to reduce unnecessary spending.

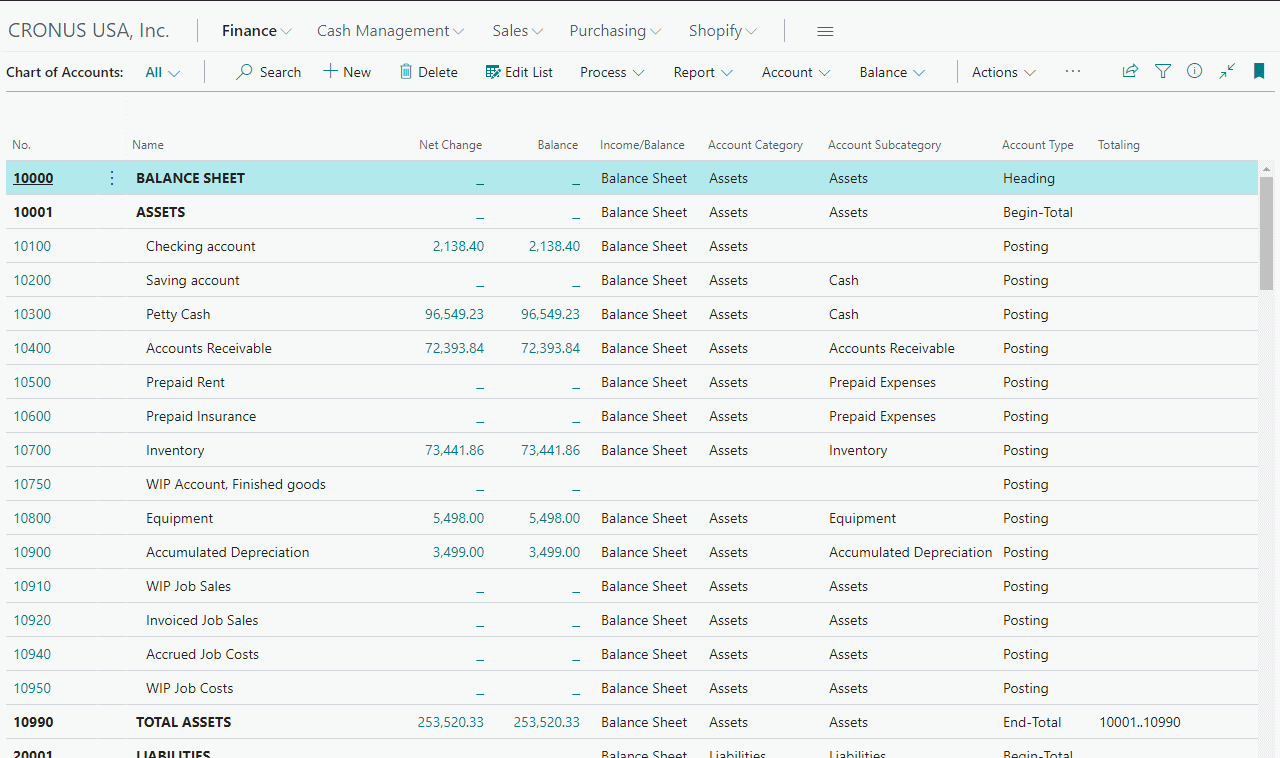

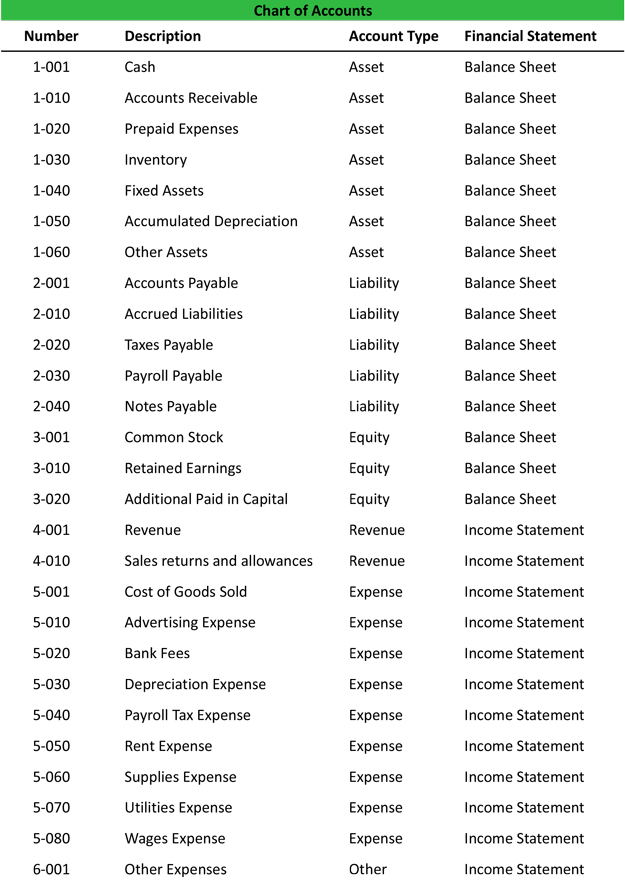

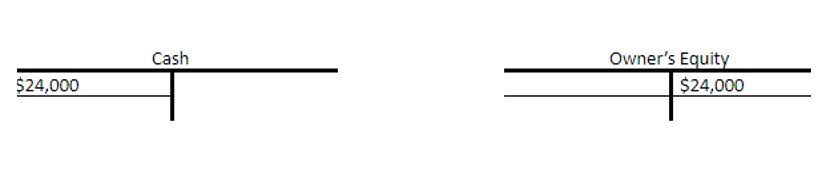

- Before we delve any deeper into the bookkeeping business, it’s important to make a distinction between bookkeepers and accountants.

Setting up dedicated business banking accounts separates personal and business finances. This Accounting Periods and Methods separation simplifies tracking of income and expenses, easing the tax preparation process. Business checking and savings accounts are essential tools for managing cash flow. Merchant services like credit card processing may be needed for client payments.

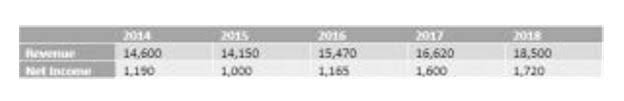

Search for other bookkeeping businesses in your area, and investigate the rates they charge for their services. Make sure to compare rates of other bookkeepers who share your credentials and experience. In a nutshell, SEO is the practice of improving your website starting your own bookkeeping business to increase its visibility when people search for products or services related to your business on search engines like Google. By focusing on keywords like “bookkeeping services” and “small business bookkeeping” in your content, and regularly updating your blog, you’ll enhance your site’s relevance and authority. This will help it rank higher on search engine results pages and make it easier for potential clients to find you. The cost of bookkeeping services varies based on factors like the bookkeeper’s experience, the complexity and volume of transactions, and the geographical location.

- This involves selecting a business structure—such as a sole proprietorship, partnership, or corporation—and registering the business name.

- Unique selling propositions, or USPs, are the characteristics of a product or service that sets it apart from the competition.

- Depending on the bookkeeping/accounting software you choose, there generally will be a payroll processing option you can turn on when you’re ready to hire employees.

- Funding your business can be achieved through various means including self-funding, small business loans, or grants for new entrepreneurs.

Sync complementary colors, fonts, imagery, and taglines across sites, cards, and presentations. Depending on your state, additional permits around service categories like tax preparation or certified accounts may be prudent to review as well. Requirements vary greatly across regions, so customize research accordingly. Having an EIN along with proper state/local tax licenses and related registrations lays the groundwork for remaining tax compliant as your practice grows.